It is based on ones occupation and easier to qualify than TPD. Income protection insurance offers 85 of your income for a certain amount of time if you cant work due to partial or total disability.

May 2021 It S Your Life Federated Insurance Catch A Break With Disability Income Insurance Federated Insurance

Furthermore in a group policy where the employer collects premiums out of the employees wages and remits them to the insur er benefits are not considered income and are not subject to tax since the entire cost is borne by.

T has disability income policy. Her monthly benefit from the policy is 15000. When you have an insurance policy you. The maximum Principal MGI benefit is 5000 per month.

There are basically three ways to replace income. But these troubles can be avoided with the help of disability insurance for professionals. For the same price you can probably get a CI policy of about 150000.

Until the Income Disability insurance becomes payable. However in case the disability exceeds 80 as per relevant certification the amount of deduction is 125000-. Disability Income DI Summary If you do opt for both the Group LTD and the Principal IDI policy you will be eligible to insure up to 75 of your net business income GIMGI to a maximum monthly benefit of 15000 per month minus all inforce coverage.

If youre still able to work but your disability has resulted in a partial loss of income duties or time then you can still receive some benefits from partial disability insurance also referred to as a residual disability benefit. Disability policies include probationary and waiting periods. The Challenge of Disability Income In 1996 the Academys Disability Policy Panel released a landmark study of disability income policy Balancing Security and Opportunity.

Each income protection service policy decides what constitutes a. If you become disabled after you retire you lose your pension Social Security or IRA income. Short-term disability STD policies provide income protection for workers temporarily unable to perform their job duties due to qualifying disabilities.

What about when disability insurance provided. 2 Some policies include. When paid by the individual disability income premiums are not tax deductible.

But is it worth it. TPD coverage only provides cover for the most severe form of disability which is where one cannot earn any income at all and such a condition must be diagnosed as permanent or if the person loses the use of any two of his eyes and limbs. Some people choose to pay for their disability insurance through individual policies using their after-tax income to pay the premiums then the income is tax-free.

Premiums for disability insurance are not deductible from ones taxes as a medical expense so it is crucial to keep that in mind when deciding on an individual policy. If your friend becomes disabled the small IRA is to be sufficient to provide for basic necessities. It replaces your employee or self-employed income based on a calculation of your annual earnings totaled from 12 months before the incident.

Beth is a surgeon who has an own-occupation disability income policy. The amount of deduction is 75000- in case of disability of 40 to 80 as certified by the relevant medical authorities. Each short-term disability claim is subject to a short elimination or waiting period that typically lasts one to two weeks during which time the policyholder does not receive benefits.

Disability Income insurance however has a more lenient form of disability definition. Since their only source of income is interrupted it is for sure they are going to face several hardships from now on. As mentioned before underwriting of disability income insurance can be rather strict and so there.

Disability income insurance is thus a good insurance to help cover any gaps in your insurance policies and ensure you have protection for a wider range of unfortunate situations. It costs about 1 dollar a day for a 3000 monthly benefit. During this time Beth has been working part-time at a local boutique and receives 2000 monthly.

Disability income DI insurance is designed to replace between 45 and 65 of the insureds gross income on a tax-free basis. If your disability insurance policy includes partial disability coverage youll have to show that a. Any amount received or accrued in respect of a policy of insurance relating to the death disablement severe illness or unemployment of a person who is the policyholder in respect of that policy of insurance Section 101gA has always exempted any disability pension paid under section 2 of the Social Assistance Act 1992 Act 59 of 1992.

The increase applied will be equal. Also called LTD this type of policy is designed to last for many years through retirement age 65 67 or Social Securitys normal retirement age if needed replacing 50-67 percent of your income for an individual policy and about 40-60 percent under group long term disability if something happens and you can no longer work. Below are key excerpts from the report that are useful to the current policy debate.

And during which period the employee was uninterruptedly disabled for work. Additional income be necessary to pay the simplest expenses. This condition must also be deemed permanent and irrecoverable.

She was injured six months ago and has been unable to return to her practice. If you are disabled or unable to work as a result of an accident or illness disability income insurance which complements health insurance can replace lost income. Escalation The insurance is increased annually at a specified rate applicable to the policy and compounded annually after payment of the Income Disability insurance has commenced.

Some injuries such as a broken spine an amputated limb traumatic brain injury and so on may be permanently disabling. Disability income insurance exists to serve as a hedge against complete lack of income in the event a person becomes disabled. Policy are not generally subject to tax.

The Challenge of Disability Income Policy. It is to be noted that such a deduction is not related to the amount spent by you. It is not easy to explain and there are much work for the adviser at very low compensation.

Individuals who get these types of disabilities may need disability income insurance in perpetuity.

Long Term Vs Short Term Disability Income Insurance By Beam Alife Issuu

Could You Live On Half A Paycheck

Trusted Union Can Help With The Right Plan That Begins Working When You Can T Disability Income P Income Protection Insurance Income Protection Health Business

Selecting A Disability Income Insurance Plan You Love Chegg Com

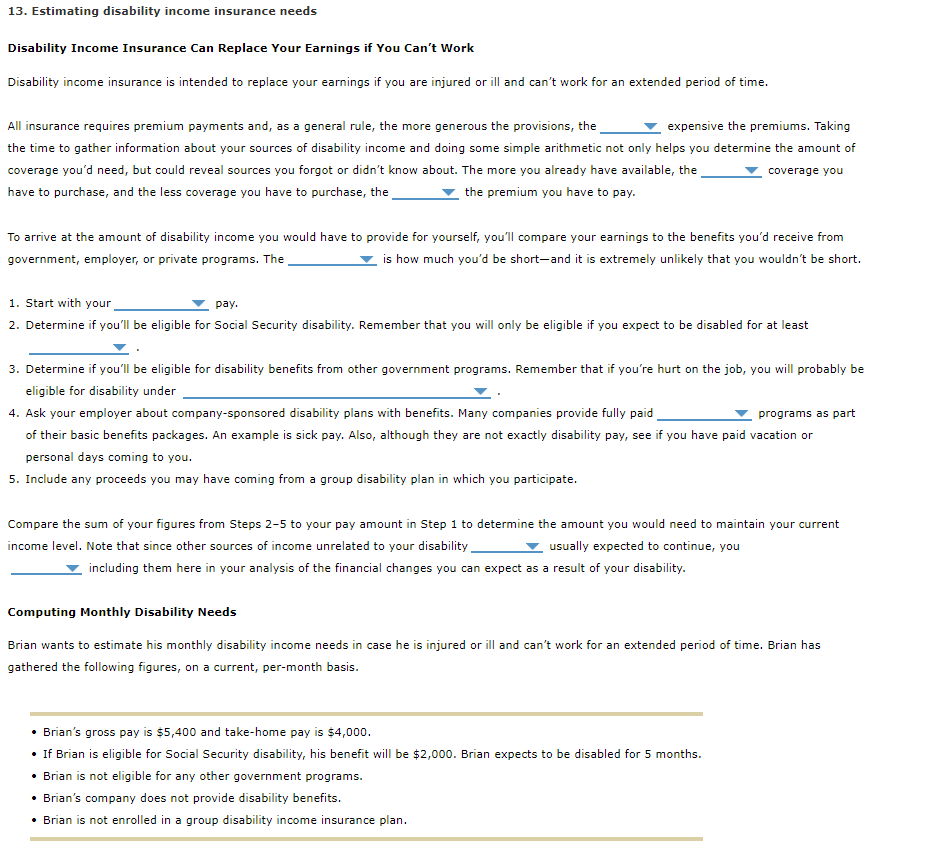

Solved Disability Income Insurance Can Replace Your Earnings Chegg Com

Disability Income Insurance Imagine Prepare Enjoy

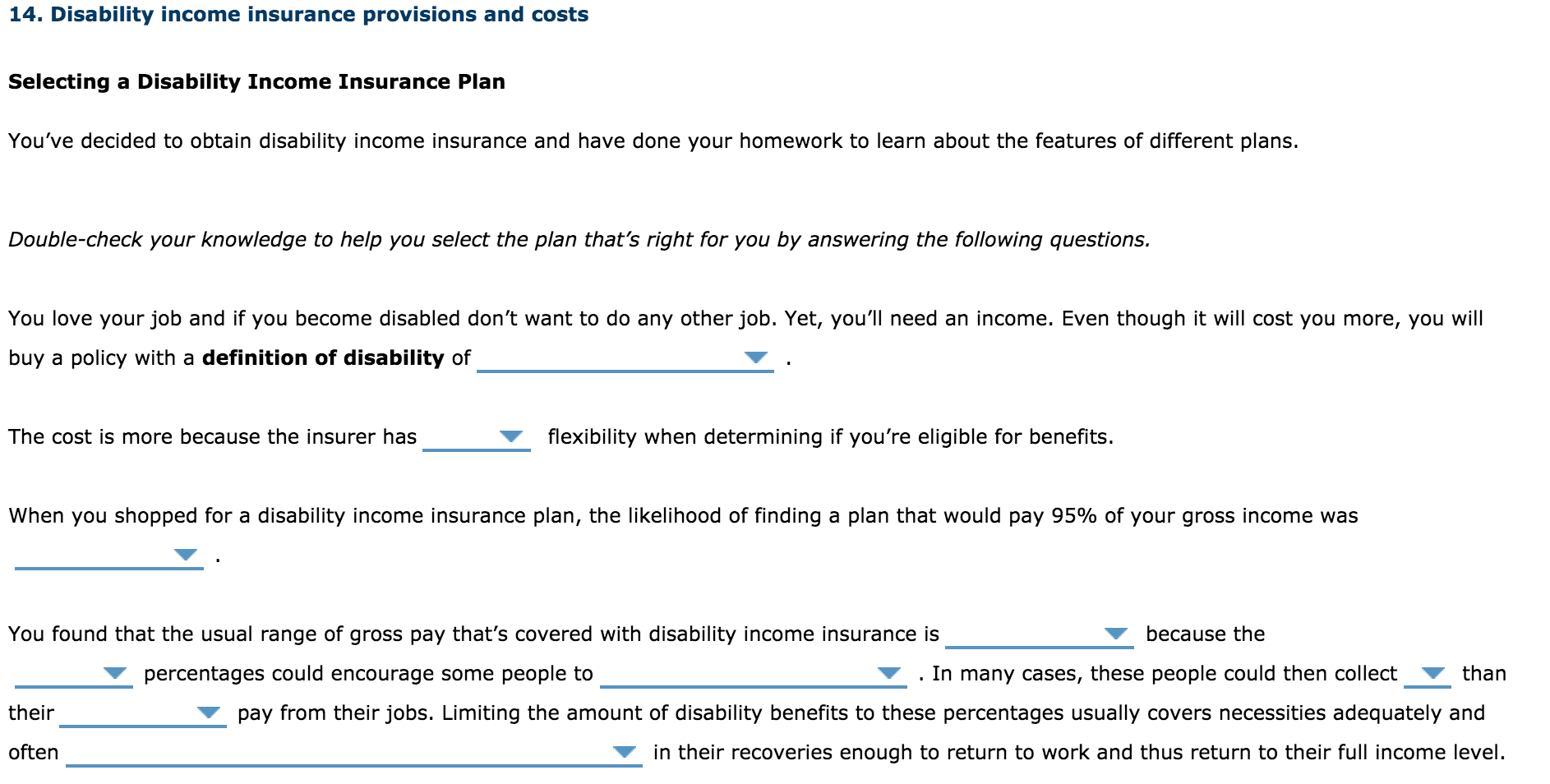

Solved 14 Disability Income Insurance Provisions And Costs Chegg Com

Disability Insurance How It Protects Your Income Guardian

14 Disability Income Insurance Provisions And Costs Chegg Com

14 Disability Income Insurance Provisions And Costs Chegg Com

Disability Income Protection A Step By Step Guide

5 Tricks For Selecting Disability Income Insurance By Ccrystal64870 Issuu

Disability Income Insurance Protecting Your Most Valuable Asset The Ability To Earn An Income Leonard Financial Solutions

5 Tricks For Selecting Disability Income Insurance By Tdavid85214 Issuu

Solved Drop Down Options 1 More Less 2 Same As 1 3 Chegg Com

5 Tricks For Selecting Disability Income Insurance By Tdavid85214 Issuu

9 1 9 Health And Disability Income Insurance

Post a Comment

Post a Comment